What is Intraday Trading, Meaning & Basic of Day Trading

Introduction

Stock market trading requires high attention to make calculated risk, identification of market movement and buying and selling at right time in intraday trading makes day trader successful.

What is Intraday Trading, Meaning & Basic of Day Trading,

Meaning Of Intraday Trading

Intraday Trading Means Buying and Selling of Financial Instrument Such as Stocks, Currencies, Commodities withing the same trading day which is also called Day Trading. In Intraday Trading traders try to book there profit or loss before the market closes, if trader fails to square of the position the broker square off from there end. Intraday traders aim to book profits by short term price movement.

Basics of Day Trading

In Intraday trading traders refers to Chart analysis, Market movement, Price action, Traders often use different strategy by paying close attention to intraday price movement. Traders use one-5- 15-30- 60-minute intraday charts when analyzing market movement within the day. Traders deploy different strategies for scalping and momentum trade which requires quick execution of trades. Traders Execute multiple order by short term market fluctuation.

Intraday Trading- Advantages & Disadvantages

Advantages of Intraday Trading

- Intraday trading is all about quick profit and traders make profit by taking advantage of short-term market movement

- Traders execute multiple orders which increase flexibility and liquidity based on multiple trading opportunity within the day

- Intraday traders get the benefits of leverage and margins

- Intraday trades get squared off before the market close and no delivery charge for day trades

Disadvantages of Intraday Trading

- Intraday trade carries high inherent risk the price movement in day trading leads to more emotional trades which incurs losses

- Volatility in day trading requires good attention and better understanding of market movement where many traders fail

- Brokerage, Transaction costs and other taxes can reduce profits which is a challenge to most of the traders

Intraday Trading Vs Delivery Trading

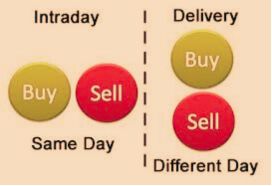

Intraday Trades is Buying and selling the stocks on the same day where as in Delivery trading the stock bought is credited in the Demat and one can hold as many days, weeks, months or years. The investor has right of ownership of stocks to get dividends. Investor look for higher time frame of market movement and price action.

Intraday Trading for Beginners

Stock Market requires good patience and understanding, Beginners need to understand following points while doing intraday trades

- Good Research: Any stock, derivative instrument or commodity requires good research of how price reacts for that day.

- Overtrades: Many traders are trading frequently in short term duration of market hours, market trends are not similar daily it changes on regular basis one need to understand the fact, overtrading is the main cause of traders fail in day trading. Beginners need to focus and consider limited trades for successful trading

- Trading Strategies & indicators: As a trader any strategy or indicators used is profitable only when a trader conducts a study, consistency is the key for success in stock market

- Risk Analysis: Proper risk managing and amount invested leads to successful trading, a trader should never take high risk in trades with proportion to capital invested

- Evaluate the performance: A good track of your performance winning and losing trades will help you understand what went right or wrong. Evaluation of past performances will always help trader making better trading decisions in the future.

Understanding Intraday Trading

Lets take an example if a trader bought 1000 shares of X company with the value of 550 here the total value will be 5,50,000 here in day trading after margin and leverage benefit for intraday the buy value will be near to 2 lakhs now if a trader hold the position till end of day and price moves to 505 the 5/- will be the profit for the day the same applies to loss trades the trader need to square off the position or it will be squared off by broker before the market closes.

FAQ

1. Is Intraday Trading Profitable ?

A. Intraday Trading is a good source of income earning from booking small profit rather expecting huge profit in one go.

2. Is Intraday trading good for beginners?

A. Before starting intraday trading one need to know about advantages and dis advantages about Intraday trades the short term profits from quick movement is always an advantage

3. What is difference between intraday trading and delivery trading?

A. The difference between is in intraday the position is squared-off on the same day and in delivery trading the holding period is more than a day.